Top 5 Machine Learning Models for LTV Prediction

Explore the top machine learning models for predicting customer lifetime value, from linear regression to neural networks, and enhance your business strategy.

Top 5 Machine Learning Models for LTV Prediction

Predicting customer lifetime value (LTV) is essential for businesses to grow and retain customers. Machine learning models help analyze complex data to make accurate predictions. Here’s a quick rundown of the top 5 models for LTV prediction:

- Linear Regression: Easy to use and interpret, but limited to simple, linear relationships.

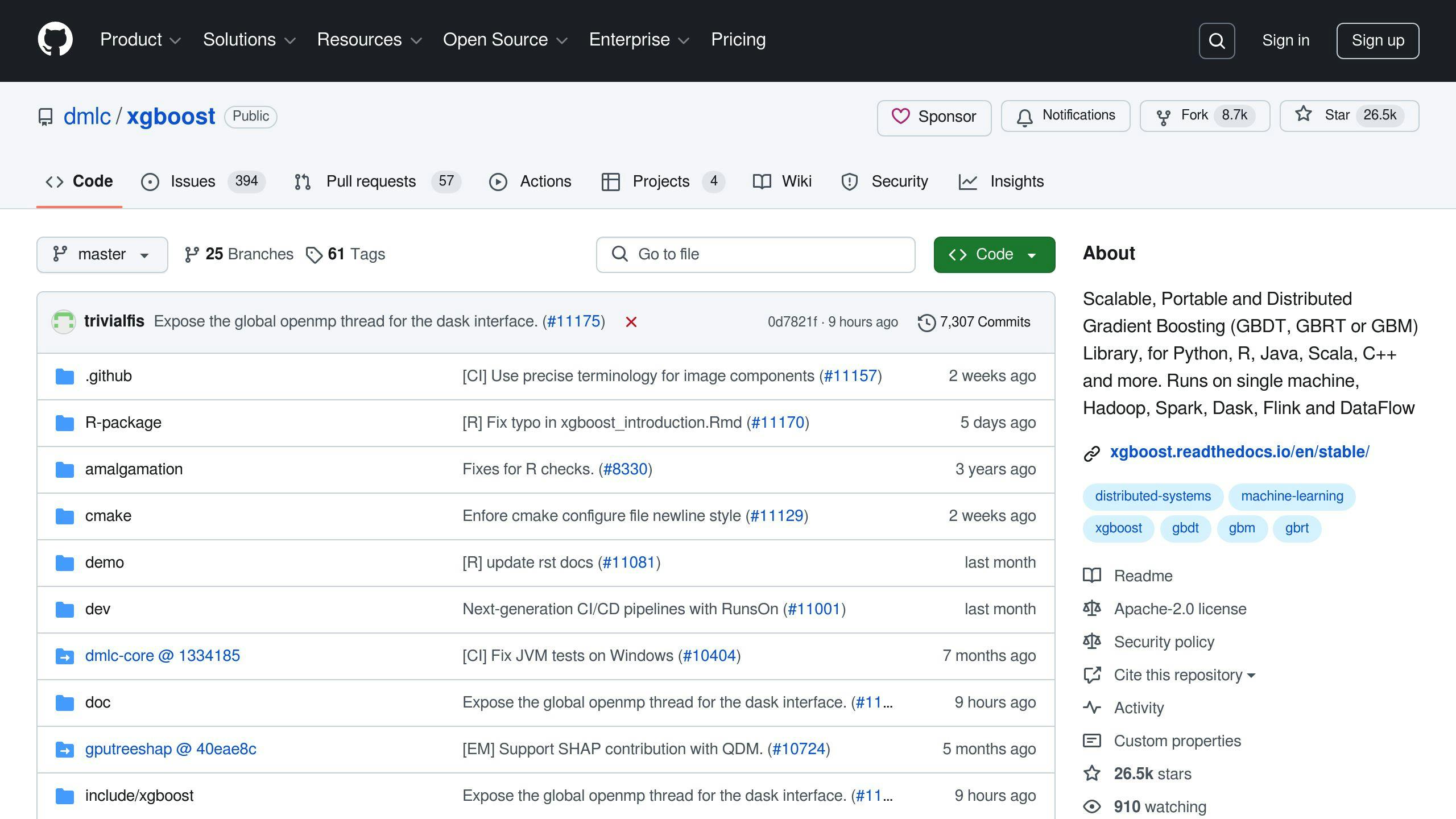

- Gradient Boosting (XGBoost, LightGBM, CatBoost): Great for handling complex patterns and large datasets; offers high accuracy.

- Time Series Models (ARIMA, ETS): Best for seasonal trends and recurring behaviors, focusing on time-based data.

- Survival Analysis: Focuses on retention and churn by analyzing time-to-event data.

- Neural Networks: Handles large, complex datasets with unmatched precision, but requires significant resources.

Quick Comparison

| Model Type | Best For | Accuracy | Complexity | Speed |

|---|---|---|---|---|

| Linear Regression | Simple, linear relationships | Moderate | Low | Very Fast |

| Gradient Boosting | Complex patterns, large datasets | High | Medium-High | Fast |

| Time Series | Seasonal trends, time-based data | High | Medium | Moderate |

| Survival Analysis | Retention, churn analysis | High | Medium | Moderate |

| Neural Networks | Complex, multi-dimensional data | Very High | High | Variable |

Each model has its strengths and trade-offs. Start with simpler models like linear regression and progress to advanced ones like neural networks as your data and resources grow.

Related video from YouTube

1. Linear Regression: A Simple Starting Point

Linear regression is a great option for businesses just starting with machine learning. This method looks at the relationship between customer characteristics and their lifetime value (LTV) by calculating the best-fit line that minimizes prediction errors .

The main advantage? It's easy to understand and interpret. For companies new to LTV predictions, linear regression offers clear insights into how specific customer traits impact value. Plus, it's quick and efficient, making it perfect for large, straightforward datasets .

However, there are limits. The model assumes a simple, linear relationship between customer traits and LTV, which may not always hold true. It's also sensitive to outliers and struggles to handle more complex, non-linear patterns in customer behavior .

Key Features of Linear Regression for LTV Prediction:

| Aspect | Details |

|---|---|

| Data Requirements | Requires clean data with continuous LTV values |

| Processing Speed | Fast and efficient |

| Interpretability | High - clear connections between variables |

| Handling Complexity | Limited to linear relationships |

| Resource Needs | Minimal computing power required |

Tips to Get the Most Out of Linear Regression:

- Prepare Your Data: Clean up your dataset by removing outliers and filling in missing values.

- Choose the Right Features: Focus on customer traits that clearly relate to LTV.

- Use Regularization: Techniques like Ridge or Lasso regression can help prevent overfitting .

Linear regression works well in industries with straightforward customer behaviors but may fall short in sectors with more complexity, like mobile gaming . Its success depends heavily on the quality of your data and the complexity of customer interactions. While it's a solid starting point, more advanced models, such as gradient boosting, are better suited for capturing intricate patterns.

2. Gradient Boosting Models: XGBoost, LightGBM, and CatBoost

Gradient boosting models have dramatically improved LTV prediction accuracy compared to linear regression. These ensemble learning techniques combine multiple decision trees, enabling them to capture complex, non-linear patterns in customer behavior data . They are particularly effective at identifying hidden factors that influence customer value, such as churn risk or opportunities for upselling.

Comparing GBM Frameworks

| Framework | Best Features/Use Cases |

|---|---|

| XGBoost | Delivers high accuracy and robust regularization; ideal for general-purpose LTV prediction |

| LightGBM | Optimized for speed and memory efficiency; works well with large-scale datasets |

| CatBoost | Excels in handling categorical features; suitable for datasets with mixed data types |

These models can reveal subtle dynamics, like how user activity interacts with purchase frequency to impact lifetime value. For example, devtodev's research highlighted the effectiveness of gradient boosting in predicting LTV for mobile games, showing how it linked user engagement metrics to future spending .

Finding the Right Balance

To achieve both accuracy and interpretability, use visual tools to analyze how specific features influence predictions. Regular retraining is also crucial to maintain model performance. Research from Adjust confirms that gradient boosting models outperform traditional methods in accuracy, though they do demand more computational power.

When selecting a framework, match it to your specific requirements:

- LightGBM: Best for applications where processing speed is critical.

- CatBoost: Ideal for datasets with a high number of categorical variables.

- XGBoost: A solid choice for general-purpose LTV prediction tasks.

Success with these models depends on high-quality data, careful feature selection, and fine-tuned hyperparameters. They are particularly effective for analyzing complex customer journeys, large datasets, and diverse customer segments.

While gradient boosting models are excellent at uncovering intricate patterns, time series models may be a better fit for sequential data, such as tracking customer engagement trends over time.

3. Time Series Models: ARIMA and ETS

Time series models are designed to analyze patterns over time, focusing on seasonal trends and recurring cycles that impact customer behavior and spending habits.

ARIMA and ETS Overview

ARIMA and ETS are two popular approaches for time series analysis, each with its own methodology:

-

ARIMA breaks down patterns using three key components:

- Autoregressive: Examines past values to predict future trends.

- Integrated: Accounts for overall trends by smoothing data.

- Moving Average: Focuses on short-term fluctuations.

- ETS dissects time series data into three main elements:

| Component | Description |

|---|---|

| Error | Random, unpredictable changes |

| Trend | Long-term directional patterns |

| Seasonality | Regular, repeating cycles |

Strengths and Limitations

These models are excellent for identifying sequential data patterns, seasonal trends, and linear relationships. However, they can struggle with nonlinear behaviors . One of their main strengths is producing clear, interpretable results, but they need frequent retraining to stay accurate as patterns shift over time .

Implementation Best Practices

To get the most out of time series models:

- Use consistent and high-quality historical data that spans full seasonal cycles.

- Choose ARIMA for analyzing complex trends or ETS when seasonality is more pronounced.

- Regularly retrain models to adapt to changing patterns.

Preprocessing and feature engineering are critical steps to ensure reliable results. For SaaS companies, these models are particularly useful for predicting subscription renewals and spotting seasonal trends in user activity.

Practical Applications

Time series models shine in forecasting revenue changes and identifying seasonal spending habits. Their success hinges on having enough reliable historical data. When applied effectively, they can offer insights that guide business strategies and decision-making.

Although time series models are powerful tools for understanding temporal patterns, they complement other approaches like survival analysis, which focuses on customer retention and churn.

sbb-itb-0499eb9

4. Survival Analysis for Customer Retention

Survival analysis focuses on time-to-event data, making it a great choice for understanding customer retention. Unlike time series models, which examine sequential patterns, survival analysis zeroes in on the timing of specific events, like customer churn. Originally developed for medical studies, this method has been adapted for predicting customer behavior.

The Cox Proportional Hazards Model

The Cox Proportional Hazards Model is a widely used approach in survival analysis, particularly for predicting customer lifetime value (LTV). This semi-parametric model is especially effective at dealing with censored data - data from customers who haven't yet churned - providing a more complete picture of retention trends.

Real-World Performance

In the telecommunications industry, the Cox model demonstrated 85% accuracy in predicting customer churn, allowing companies to take action before losing customers . This level of precision enables businesses to implement retention strategies that are both timely and effective.

| Aspect | Traditional ML Models | Survival Analysis |

|---|---|---|

| Time Consideration | Static predictions | Dynamic, time-based insights |

| Censored Data Handling | Limited | Naturally incorporates incomplete data |

| Interpretability | Varies | Clear and easy to interpret |

| Implementation Complexity | Moderate | Moderate, depending on data preparation |

Implementation Tips

To make the most of survival analysis:

- Use high-quality data and include key features like customer lifecycle events to boost accuracy.

- Regularly update models to account for changes in customer behavior and preferences.

- Continuously monitor outcomes to ensure the model reflects current trends.

Research by Kurki (2020) found that combining survival analysis with machine learning techniques outperformed traditional methods, like linear regression, for predicting LTV .

Technical Integration

Tools such as Python's lifelines library and R's survival package make it easier to implement survival analysis. These tools integrate well with machine learning frameworks like scikit-learn, streamlining the process.

While survival analysis is excellent for retention-focused predictions, neural networks can handle more complex, multi-dimensional customer data, offering additional insights for businesses looking to deepen their understanding of customer behavior.

5. Neural Networks for Complex Data

Neural networks take customer behavior analysis to the next level by building on the capabilities of gradient boosting and time series models. These deep learning models are great at identifying subtle patterns in large and complex datasets.

Types and Applications

Different types of neural networks serve specific purposes:

- Feedforward Neural Networks: Handle static, nonlinear relationships effectively.

- Long Short-Term Memory (LSTM) Networks: Specialize in sequential data, making them ideal for analyzing long-term trends in customer behavior. For example, LSTMs can predict future actions by studying past interactions.

Performance and Benefits

Neural networks shine in scenarios involving complex customer journeys, multiple touchpoints, and large-scale data. Their ability to identify multi-dimensional patterns gives them an edge over simpler models.

| Aspect | Traditional Models | Neural Networks |

|---|---|---|

| Data Volume Requirements | Moderate | High |

| Pattern Recognition | Basic | Advanced |

| Scalability | Limited | Excellent |

| Processing Speed | Fast | Variable |

| Model Interpretability | High | Low |

Key Steps for Implementation

To implement neural networks effectively:

- Ensure input features are normalized and datasets are complete.

- Choose the right architecture based on your specific needs.

- Use metrics like MAE (Mean Absolute Error) and RMSE (Root Mean Square Error) to track performance.

Real-World Applications

Advanced models like MCD-DCNv2 perform exceptionally well, especially for users with no purchase history, delivering better accuracy in metrics like MAPE and hit rate . When integrated with systems like CRM and ERP, these models can adapt to evolving customer behaviors seamlessly .

Although neural networks offer unmatched precision for complex predictions like lifetime value (LTV), they require significant resources and infrastructure. For many businesses, they work best alongside other methods, such as survival analysis, to enhance retention strategies.

Comparison Table of LTV Prediction Models

Let's break down the key features of various LTV prediction models to help you choose the right one for your needs. This table highlights practical aspects like ease of implementation, accuracy, and processing speed.

| Model Type | Best Use Cases | Technical Requirements | Implementation Complexity | Prediction Accuracy | Processing Speed |

|---|---|---|---|---|---|

| Linear Regression | Simple linear relationships, limited data, early-stage startups | Small datasets, basic computing tools | Low | Moderate (for linear data) | Very Fast |

| Gradient Boosting (XGBoost, LightGBM, CatBoost) | Large-scale use, complex interactions, diverse customers | Large datasets, moderate computing resources | Medium-High | High | Fast |

| Time Series (ARIMA/ETS) | Seasonal trends, cyclical behaviors, trend forecasting | Historical time-stamped data, moderate resources | Medium | High (for time-based patterns) | Moderate |

| Survival Analysis | Churn analysis, purchase timing, subscriptions | Event-time data, moderate computing power | Medium | High (for time-to-event predictions) | Moderate |

| Neural Networks | Complex customer journeys, multi-channel data, large-scale operations | Large datasets, advanced computing power | High | Very High | Variable |

Key Performance Considerations

Choosing the right model depends on three main factors:

- Data and Resources: Neural networks need extensive data and powerful infrastructure, while linear regression and gradient boosting are more resource-friendly.

- Time Sensitivity: Time series models shine when predicting seasonal or cyclical patterns.

- Model Transparency: Linear regression provides clear, easy-to-interpret insights, while neural networks are more opaque and complex.

Model-Specific Performance Metrics

| Model | MAPE (Mean Absolute Percentage Error) | Average Processing Time |

|---|---|---|

| Linear Regression | 25-35% | Seconds |

| Gradient Boosting | 15-25% | Minutes |

| Time Series | 20-30% | Minutes |

| Survival Analysis | 18-28% | Minutes |

| Neural Networks | 10-20% | Hours |

For SaaS businesses, experts like Artisan Strategies suggest weighing technical capabilities against business needs. They note that while neural networks deliver top-tier accuracy, many growing SaaS companies find gradient boosting models to be a better fit due to their balance of accuracy and manageable implementation .

Ultimately, your choice should align with your business goals, available resources, and technical expertise. For instance, if you’re working with complex customer behaviors and have robust infrastructure, neural networks might be worth considering. On the other hand, if you need quicker insights and have limited resources, linear regression or gradient boosting could be more practical .

This comparison equips businesses to make smart decisions about which model to pursue, paving the way for effective implementation strategies.

Conclusion

Choosing the best model for your business depends on factors like available resources, data readiness, and specific goals.

Different models address different needs. Linear regression works well for startups with fewer resources, while gradient boosting models are ideal for growing businesses that need more precise predictions. If your business relies on seasonal trends, like subscriptions, time series models are a great fit. For retention-focused insights, survival analysis is the go-to. Meanwhile, enterprises with complex customer journeys and ample resources may benefit from the higher accuracy of neural networks, despite their complexity .

To maintain accuracy, models should be updated regularly to reflect changing conditions. Evaluating performance with a mix of metrics - such as the normalized Gini coefficient and Mean Absolute Percentage Error (MAPE) - provides stronger validation across various scenarios and customer groups .

The journey to reliable LTV prediction is a step-by-step process. Begin with straightforward models and transition to more advanced ones as your business scales and your data capabilities expand. This approach ensures your predictions grow in value alongside your business.

Built by Artisan Strategies

Here at Artisan Strategies we both help companies accelerate their own revenue and launch our own products to improve your daily life. Whether it's for productivity (Onsara for macOS) or simply a better dictionary in Chrome (Classic Dictionary 1913), we've built something for you.